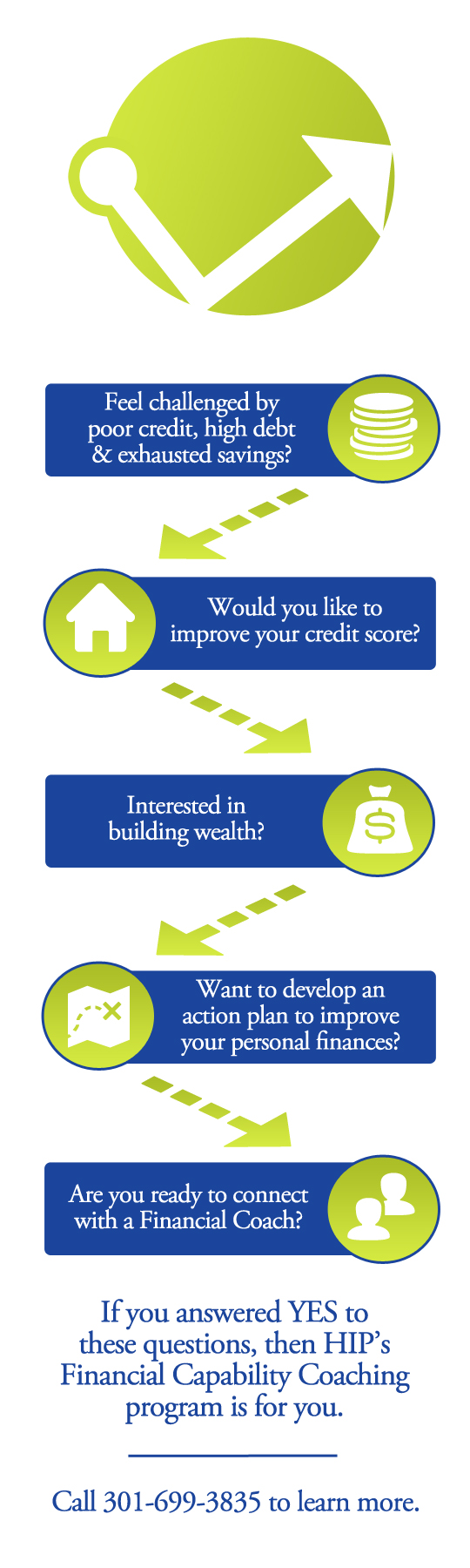

Financial Capability Counseling gives families and individuals from all walks of life the information and tools needed to improve credit, increase savings and build wealth.

HIP now integrates its financial capability coaching into its free, one-on-one sessions with housing counseling clients. We coach renters, first-time homebuyers and homeowners.

Individual Coaching

Our certified housing counselors will analyze your finances and help you to develop a spending plan and identify clear financial goals. At the conclusion of the first session, you will have developed a customized roadmap with well-defined steps to achieve your particular financial goal. Sign up for individual counseling by contacting HIP’s Prince George’s County Intake Specialist at 301-699-3835 or Montgomery County Intake Specialist at 301-916-5946.

We are ready to help you achieve your financial goals.